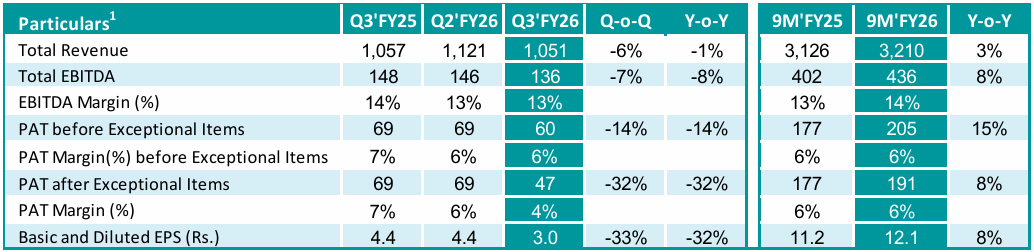

All figures are in ? Crore unless otherwise stated.

The Board of Jubilant Ingrevia Limited met on February 4th, 2026 to approve financial results for the quarter ended December 31st, 2025.

Commenting on the Company's performance, Mr. Shyam S Bhartia, Chairman and Mr. Hari S Bhartia, Co Chairman, Jubilant Ingrevia Limited said:

"We are pleased to share the financial results for the third quarter and nine months of this fiscal year. On a year to date basis, our Speciality Chemicals segment has continued to fuel growth momentum, delivering revenue expansion and a robust double- digit increase in EBITDA. Our Nutrition business has sustained a healthy trajectory of volume growth across all core products. At the same time, our Chemical Intermediates segment has successfully maintained its market share while recording year on year volume growth.

This quarter presented its challenges, with softer pricing across all three segments. However, strong volume growth helped offset this impact, resulting in overall business performance remaining stable. EBITDA % was maintained at 13% same as Q2. Over the nine month period, our volume grew in double digits, leading to revenues increasing by 3%, EBITDA rising by 8%, and even after accounting for the amendment to the Indian Labor Code and the associated one- time exceptional expense, our Profit After Tax registering an 8% growth.

We are pleased to announce that the Board has recommended an interim dividend of 250%, translating to Rs2.5 per equity share.

Markets Update:

cross the broader Chemicals Industsry, we are witnessing a steady recovery in volumes, even as pricing pressures continues to persist across segments. Importantly, while many global players are reporting deteriorating financials due to weaker demand, sustained pricing pressure, and elevated energy costs, our performance demonstrates resilience and strength in navigating these challenges.

In the pharmaceutical end-use market, volumes have remained steady across segments, with particular strength in our core Fine Chemicals portfolio. With recent signing of FTA between United States & India, the market is expected to improve in the near future, on the back of customers getting more clarity on tariffs and reduced geopolitical uncertainties.

In the Agrochemical sector, we are witnessing a steady recovery in volumes both globally and in India, with Pyridine- based products and the Acetyls group showing consistent improvement. However, the demand-supply imbalance persists, exerting short- term price pressure that we expect will ease in the coming quarters. We continue to advance our cost initiatives to ensure we can absorb this impact.

In the Nutrition market, Niacinamide demand remains strong across key segments including Feed, Food, and Cosmetics. Pricing, however, has been under strain due to supply-demand mismatches, though we anticipate margins to improve marginally in the next quarter. Meanwhile, demand for Choline (Vitamin B4) is stable. While domestic prices are affected by global imports, we are encouraged by positive traction in the European market, supported by tariffs imposed on Chinese suppliers.

Future Outlook

Looking ahead to Q4 FY26, we anticipate sustained growth momentum, driven by progress in our Specialty Chemicals and Nutrition businesses, alongside a partial recovery in the Acetyls portfolio. During the quarter, we commissioned a new boiler at our Bharuch site, which will further enhance our operational efficiency. We are also on track to commence delivery of a major CDMO order in Q4'FY26, a milestone that will significantly accelerate our growth trajectory in the CDMO segment. In addition, construction work has begun on our new multipurpose plant in Gajraula, which will further strengthen our capacity and future readiness for upcoming CDMO projects. With the latest FTAs signed with Europe and the US, we expect to gain share in these markets in the coming quarters."

Commenting on the Company's performance, Mr. Deepak Jain, Chief Executive Officer and Managing Director, Jubilant Ingrevia Limited said:

"Over the past year, we have made significant progress across all pillars of our strategy, laying the groundwork for sustained long-term growth while ensuring stability in the near term, even amid current challenging global market conditions. These efforts are already delivering results, as reflected in our stable quarterly performance in our Specialty and Nutrition portfolio, overall margins, along with a substantially expanded pipeline of more than 100 new opportunities, including 16 wins this year. In Q3 FY26, we further accelerated our Pinnacle journey, achieving important milestones that reinforce our momentum and strengthen our trajectory toward enduring value creation."

Let me share the overall Business update with you all:

1. From an overall business wide perspective, we are pleased to report stable revenues and margins, delivered despite challenging market conditions. This performance was fueled by incremental sales volumes across all segments.

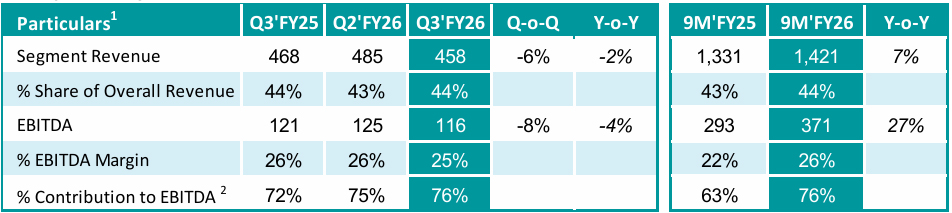

2. While volumes grew during the quarter, performance in our Specialty Chemicals segment was tempered by pricing pressures across core products. Nevertheless, the segment demonstrated resilience, continuing to deliver margins above 25%, underscoring its strong fundamentals even in a challenging environment.

- Our Pyridine and Derivatives business continued to deliver strong volume growth on both QoQ and YoY basis, reflecting the robustness of market demand and reaffirming our competitive positioning

- Diketene Derivatives maintained steady volumes on a QoQ basis and demonstrated strong growth momentum YoY, reflecting consistent performance and clear market traction.

- In our CDMO business, we continue to see increased customer traction across Pharma, Agro, Industrial and Cosmetics/Nutrition segments. The overall momentum underscores the strong demand and growing confidence in our capabilities.

- We continue to make rapid progress in our new growth segments such as cosmetics and semi-conductor chemicals. In Cosmetics, our team has already developed multiple products and we are getting good traction with several customers. Similarly, in semi-conductor chemicals too, the number of opportunities has increased in last quarter, and we are making significant investments in equipment and teams to accelerate our journey.

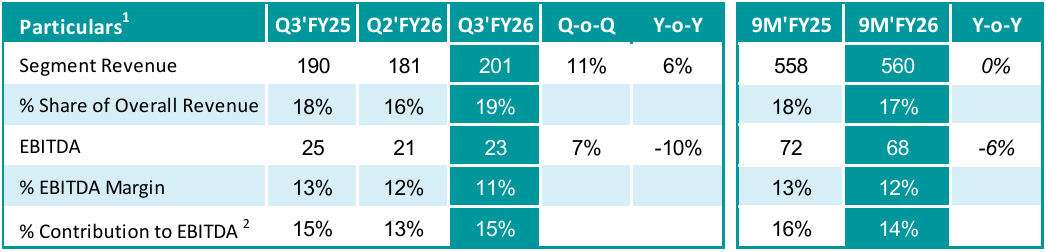

3. In our Nutrition and Health Solutions business, we delivered volume growth both quarter-on-quarter and year-on-year. Demand for feed-grade Vitamin B3 remained steady, with volumes reaching their highest level in the past seven quarters. While intensified global competition placed some pressure on prices, the segment continued to demonstrate resilience. Cosmetic-grade demand sustained its steady growth on both QoQ and YoY basis, with pricing remaining stable. In food-grade products, we observed marginal price softening, though demand trends remained encouraging and supportive of long-term growth.

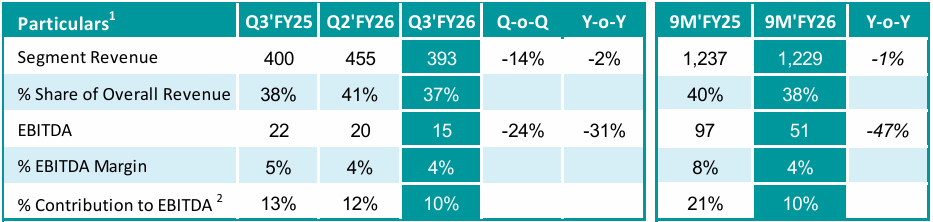

4. In our Chemical Intermediates segment, we recorded higher market volumes in the domestic market, supported by a modest uptick in agrochemicals and paracetamol end-use segment. In contrast, Europe continues to face headwinds, with weak demand and plant closures weighing on performance. While prices have remained subdued, rising raw material costs and positive momentum in Acetic Acid point toward an upward trend ahead. Importantly, our lean initiatives and cost-efficiency measures have helped offset pricing pressures, reinforcing the resilience of this segment.

A quick update on the progress made across our 5 pillars:

1. Driven by our customer centric approach, our Key Account Management strategy continues to deliver strong results. In Q3, we expanded our opportunity funnel beyond 100 active opportunities, reflecting deeper engagement and growing interest across our strategic accounts. Collectively, these opportunities represent a peak annual revenue potential of Rs 3,500 crore. Over the past year, we have secured confirmation for more than 16 molecules with an estimated peak potential of Rs 1,400 crore, and we are in advanced discussions on over 7 additional opportunities with a potential of Rs 900 crores.

2. From an Operations and ESG perspective, we are seeing tangible outcomes from our sustainability initiatives. The benefits of green power are evident, with Power and Fuel expenses reduced by 10% YoY and around 3% QoQ, despite higher production volumes. This progress reflects the successful commissioning of Renewable O2 Power at our Bharuch site, which has taken Ingrevia's renewable power share to 34% in Q3 as against 28% in Q2, a significant milestone in our clean energy journey. On the operational front, our Rs 120-crore-plus annual Lean savings program remains firmly on track, driving efficiency across the value chain. Complementing these efforts, our ESG initiatives earned significant recognition last quarter. We received multiple recognitions at the 7th South Asia ASQ Team Excellence Awards and were also awarded as the Manufacturing Team of the Year 2025 (Large) at the Manufacturing Today 13th Annual Conference & Awards. These accolades highlight our unwavering commitment to responsible practices and sustainable growth.

3. From a People and Organization perspective, I am pleased to share that we have been recognized among the Top 50 Best Workplaces™ in Manufacturing in India for 2026. We continue to strengthen our leadership bench with strategic senior talent additions. This quarter, we welcomed a new Chief of Manufacturing, further reinforcing our operational excellence. In addition, we remain committed to continuously strengthening our R&D and Technology teams through key hires in strategic growth areas such as Human Nutrition and Semiconductors, positioning us for long-term success.

4. On the Innovation and R&D front, we continue to build a strong pipeline that supports our long-term growth strategy. We now have approximately 55 products vs 50 in Q2 under development across our business segments, reflecting our commitment to differentiated and value-added solutions. These innovations will further strengthen our portfolio and reinforce our position as a science-led, customer-centric organization.

On the capex front, we commissioned a new boiler at our Bharuch site in Q3 FY26, further enhancing operational efficiency. We remain firmly on track for the Q4 commissioning of our $300 million Agro-Innovator project, a key milestone in our growth strategy, successfully completed within an accelerated timeframe of just 14 months, and slated to begin dispatching volumes from March 2026. During the quarter, we also commenced construction of a new multipurpose plant at Gajraula, which will add significant flexibility and capacity to our CDMO and Fine Chemicals portfolio. Given the progress across our strategic initiatives, we remain confident in sustaining the expected growth trajectory in both topline and margins over the next quarters."

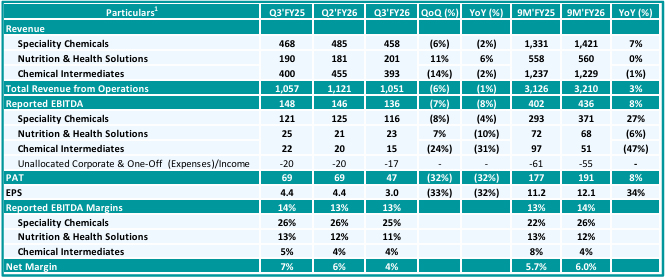

Q3'FY26 Highlights | Segment Wise Analysis

A. Speciality Chemicals

- All figures are in Rs Crore unless otherwise stated

- Before adjustment of Unallocated corporate expense/Income

Market Highlights

Pharma

- Pharma End-use demand remained stable across both YoY and QoQ basis

- Pricing remained muted

- US: Customers remain cautious amidst US tariff uncertainty

Agrochemical

- Continue growth across volumes on both YoY and QoQ basis

- Witnessed further marginal price softening in pyridine and its derivatives

CDMO

- Increased traction from customers across Pharma, Agro, Cosmetics/Nutrition segments

- 100+ new opportunities in CDMO/ Fine Chemicals portfolio with 3.5Kcr+ peak revenue potential;

- 16+ molecules added in last one year with 1400cr+ peak revenue potential; 7+ more in advanced stages

Business Drivers

- Segment revenue was affected due to pricing pressure across Core products despite volume growth across pyridine and diketene portfolios

- Margins continued to remain above 25% trajectory, on account of:

- Favourable product mix with higher offtake from Fine Chemicals and CDMO offerings

- Ongoing cost optimization initiatives

- Sequential drop in EBITDA was driven by price volatility in Pyridine and Picolines

B. Nutrition & Health Solutions

- All figures are in Rs Crore unless otherwise stated

- Before adjustment of Unallocated corporate expense/Income

Market Highlights

Feed B3

- Market demand remained steady; Recorded highest ever volumes in last 7 quarters

- Competition volume push weighed on global prices

Food & Cosmetic B3

- Cosmetic-grade demand grew steadily on both QoQ and YoY basis;

- Prices for cosmetic-grade products remained stable; Marginal price softening in food grade

Choline

- Continued pressure from China imports in the domestic market; JVL volumes remained stable;

- Continued traction in EU with increase in queries after anti-dumping duties on China

Business Drivers

- Revenue growth driven by highest ever volume growth across B3 Portfolio; volume remained stable across Choline

- Margins trended lower with 11% driven by price decline across B3 portfolio and Choline; expected to increase in coming quarters as prices recover and share of cosmetic/food grade increases in overall mix

C. Chemical Intermediates Segment

- All figures are in Rs Crore unless otherwise stated

- Before adjustment of Unallocated corporate expense/Income

Market Highlights

volumes

- Increase in India market volumes with marginal uptick in agro and paracetamol

- Continued market challenges in Europe, driven by weak demand outlook and plant closures

Cost

- Positive momentum in Acetic Acid price; prices expected to go up in the near future

- Lean and other cost initiatives supported to offset pricing pressure

Prices

- Segment realization were lower on YoY basis

- Prices remained subdued, although expected to rise with increasing raw material costs

Business Drivers

- QoQ revenue declined driven by lower realization across key products: Acetic Anhydride and Ethyl Acetate, also because of lower volumes due to shutdown in Nira plant

- YoY revenue declined due to lower realization, despite volume across products

- EBITDA declined on account of lower sales and pricing pressure

- EBITDA was stable QoQ, YoY drop was primarily driven by market-induced contribution erosion

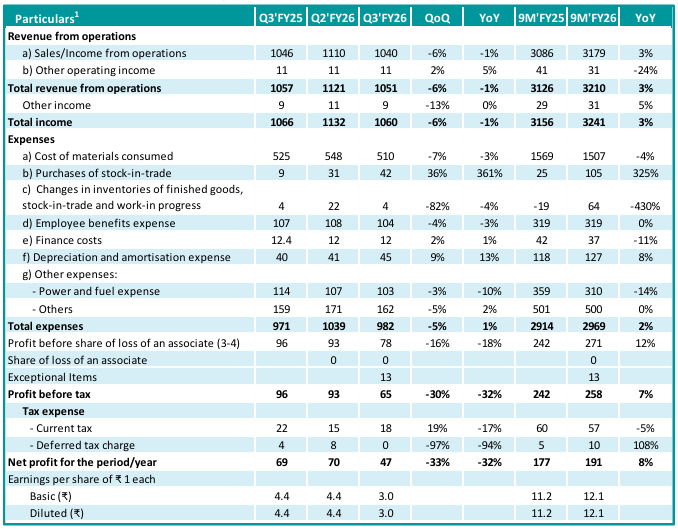

3. Income Statement - Q2'FY26

All figures are in Rs Crore unless otherwise stated

All figures are in Rs Crore unless otherwise stated

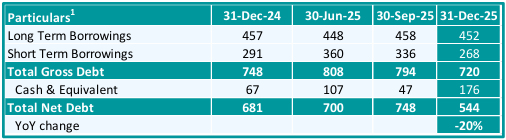

5. Debt Position as on 31st December, 2025

All figures are in Rs Crore unless otherwise stated

Capital expenditure for the quarter stood at Rs 265 crore, primarily directed towards the upcoming CDMO plant at Bharuch and ground breaking of new MMP at Gajraula. For the nine-month period of FY26, total capex amounted to Rs366 crore.

Reduced net debt through effective working capital optimization and prudent inventory rationalization.

The working capital reduced to 17.4% in Q3'FY26 from 20.1% during Q2'FY26.

About Jubilant Ingrevia Limited

Jubilant Ingrevia Limited is a leading player in Specialty Chemicals & CDMO globally, serving Pharmaceutical, Nutrition, Agrochemical, Consumer, Semiconductor and Industrial customers. It offers customised solutions that are innovative, cost effective and conform to global quality standards and has a broad portfolio of 130+ products.

It has over 45 years of legacy in the chemicals industry and is amongst the top players globally in Pyridine & Picolines, Pyridine derivatives, Acetic Anhydride, Vitamin-B3 and many other products. Jubilant Ingrevia Limited has a fast-growing Custom Development and Manufacturing business (CDMO) serving pharmaceuticals, agrochemicals and semiconductor sectors. The Company serves customers in US, EU, Japan, Middle East, South East Asia and other geographies, in addition to domestic market from its 50 plants across 5 manufacturing facilities in India with a workforce of over 2,300 employees. Its three R&D centres employ 150 scientists working on cutting-edge research and innovation.

Jubilant Ingrevia Limited is a Responsible Care certified company and ranked highly in global ESG indices such as Ecovadis and Dow Jones Sustainability Index. In 2024, Jubilant Ingrevia Limited was also recognised by the World Economic Forum (WEF) and entered its prestigious Global Lighthouse Network (GLN) for deployment of 4IR technologies.

For more information, please visit: www.jubilantingrevia.com.

For more information, please contact:

Earnings Call details: The company will host earnings call at 5.00 PM IST on 05th February, 2026

Diamond Pass Log-In

| Pre-registration: |

To enable participants to connect to the conference call without having to wait for an operator, please register at the below mentioned link.

Click here to register: Expression of the Call

Yoou will receive dial in numbers, passcode and a pin for the concall on the registered email address provided by you. Kindly dial into the call on the Conference Call date and use the passcode & pin to connect to call.

|

| Conference Dial-In Numbers |

Universal Access:

+91 22 6280 1141

+91 22 7115 8042

Toll Free Numbers:

USA: 1 866 746 2133

UK: 0 808 101 1573

Singapore: 800 101 2045

Hong Kong: 800 964 448 |

| Audio Link: |

The Audio link will be available on the company website. Please access the link here:

https://jubilantingrevia.com/investors/financials/quarterly-results

|

Disclaimer:

Statements in this document relating to future status, events, or circumstances, including but not limited to statements about plans and objectives, the progress and results of research and development, potential product characteristics and uses, product sales potential and target dates for product launch are forward looking statements based on estimates and the anticipated effects of future events on current and developing circumstances. Such statements are subject to numerous risks and uncertainties and are not necessarily predictive of future results. Actual results may differ materially from those anticipated in the forward-looking statements. Jubilant Ingrevia Limited may, from time to time, make additional written and oral forward looking statements, including statements contained in the company's filings with the regulatory bodies and our reports to shareholders. The company assumes no obligation to update forward-looking statements to reflect actual results, changed assumptions or other factors.